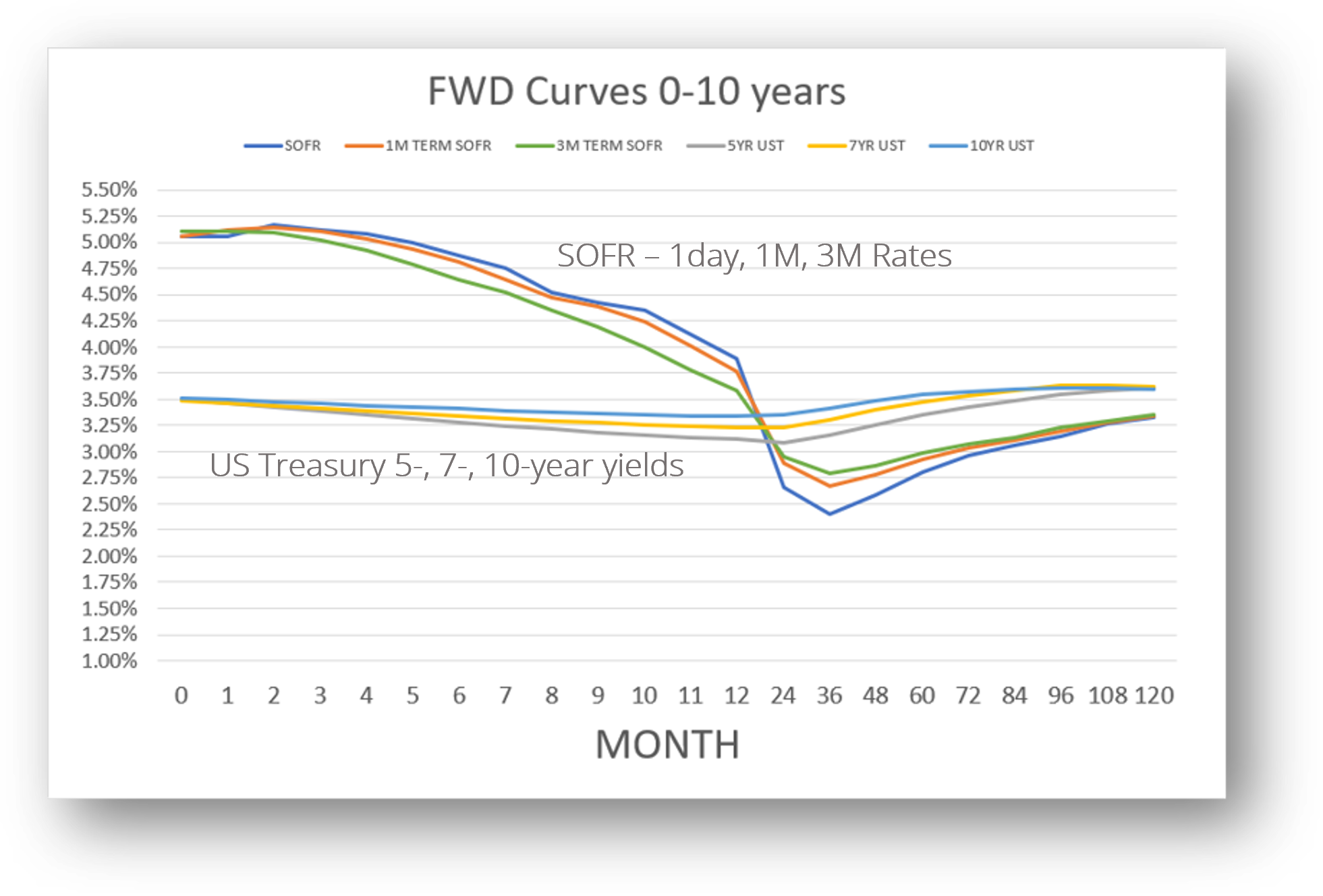

Contrary to common perception, the forward curve is not an accurate projection of future rates and, in general, should not be relied upon without considering other factors. Rather, it represents the market’s net position or indifference between various fixed and floating rate indexes. This tool shifts in response to market forces, influencing financial contracts and instruments tied to interest rate benchmarks such as SOFR products and various treasury tenors.

Analytics are often based on current rates and yield curves, at any given point in a trading day, representing ‘what we know now’. Forward curves play an additional role in debt management analyses by adding a forecasted element of rate variability over time, which can guide decisions regarding timing and strategies for loans in your portfolio. Take the following for example: the choice between fixed and floating-rate loans, evaluation of prepayment/defeasance exit costs, interest rate hedging strategies (for floating rate loans), and in general the timing of when to sell or refinance.

Implied forward curves change throughout each trading day as new aggregated economic and financial data are digested and acted upon by fixed-income investors and traders. They are constructed through industry standard and accepted methods using market data, mathematical modeling, smoothing, and statistical techniques. Thirty Capital Financial employs their own quantitative models to analyze and interpret market expectations from current rates, futures contracts and interest rate swaps curves.

Strategic decision-making in commercial real estate may not require nuanced understanding of market dynamics and financial trends. Since there’s no crystal ball for markets and rates, savvy owners and investors typically rely on their own perception of current market conditions, expectations of future rates, and factors like the forward curve and curve shocks/sensitivity to navigate uncertainties and make strategic decisions.

In other instances, when there is an imminent maturity, a need to sell/refinance in the near future, upcoming rate cap expiration, etc., CRE owners can use forward rate curves and sensitivity analyses to stress transaction economics and costs. Alternatively, interest rate hedging products are executable off of the forward curve where actual and physical trades may occur at points along the forward curve. For recent transactional examples where the forward curve has been inverted (i.e. there is anticipation that short term rates/SOFR would be lower in the near future), Thirty Capital Financial has priced many forward-starting rate caps beginning at that lower point in the future to reduce costs compared to a spot-starting cap today. While some may use forward curves to lock in favorable hedging economics, others may disagree with what the forward curve is pricing in and hedge to ‘bet against’ the curve if it’s perceived that the market is mispricing certain economic factors or conditions. We prioritize a comprehensive approach that weighs various factors and objectives rather than relying solely on forward curves.

Forward curves provide additional data points to CRE professionals to shape outlook, for informed decision-making, and for potential risk management in commercial real estate finance.

Contact Thirty Capital Financial today to leverage our expertise and receive personalized solutions for your defeasance, interest rate hedging, and debt management needs.

“We appreciated your patience as you explained very clearly each step of a highly technical process and made yourself available when we needed you to answer questions or provide information. Your efforts made the process seem flawless.”

“Thirty Capital Financial provides true turnkey service. We are a very hands-on client, and the group has met our expectations for process management, cost efficiency, and timing every time. Thirty Capital Financial provides an objective, expert service that helps us meet our transaction goals.”

“Your expertise was critical in making this transaction run smoothly from start to finish. Your knowledge and professionalism made this transaction seamless. You took what could be a complicated transaction and made it easy!”

Use our Defeasance & Yield Maintenance Calculators to get an accurate estimate in just a few minutes.

Ask about defeasance, yield maintenance, or interest rates hedging.

Provide your email address to receive regular market perspectives, research, and news from Thirty Capital Financial.

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields