For over a decade, the Commercial Real Estate market benefited from an unprecedented cycle of historically low interest rates and a normal upward sloping treasury yield curve. This led to ultra-low financing rates but also expensive early exit defeasance scenarios. The interest rate landscape has shifted radically in recent months, making deal structuring and overall transaction economics much more difficult. One of the few silver linings from this market turmoil has been dramatic reductions in defeasance and prepayment costs. Some borrowers have realized a 125%+ reduction in costs, compared to estimates received in Q1. For context, defeasance economics and early loan exit costs are fundamentally driven by:

- Prevailing market interest/discount rates: The higher the treasury/discount rate(s), the cheaper the exit costs. Keep in mind that the relevant rates are loan specific and for treasuries that closely match the maturity date of the loan.

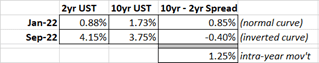

Interest rates in general have come up significantly since Q1 2022 due to an ongoing series of aggressive Fed interest rate hikes to combat inflation and address other geopolitical and macroeconomic concerns. Generally speaking, Fed meetings and rate decisions, which control the overnight Fed Funds Rate, are reactive steps to deal with current and backward-looking market factors. Short term treasury rates with maturities less than 3 years are more immediately impacted by Fed rate policy decisions. The longer end of the treasury yield curve is driven more by speculation and open-market consensus about future economic conditions. Yield movement on 10-year treasuries is generally separate from the shorter end of the curve, will experience less of a direct effect from Fed rate hikes, and may not move in lock-step with the federal funds rate.

10-year treasury rates have increased over 200bps since the start of the year. The volume and speed of those rate increases created an ‘inverted’ yield curve environment. This means that interest rates on the short end of the curve rose above the longer maturities.

In many instances, the short end of the curve has also risen above the interest rates of outstanding loans.

- The underlying interest rate on the existing loan: Generally speaking, the greater the gap between current treasury rates and the loan interest rate, the higher the cost to exit the loan; alternatively, the smaller the gap in rates, the cheaper the exit fee. If the treasury rates go above a loan’s interest rate, you have an opportunity to defease at a discount.

Loans that are currently being defeased or prepaid early are from loan vintages when borrowing costs were historically low. These low loan coupons are being defeased with treasuries that have yields similar to, or at times higher than, the loan interest rate. As rates on treasuries approach or surpass loan interest rates, more transactions are being defeased at par, or even at discounts to their remaining principal balance. Keep in mind, many yield maintenance prepayments carry minimum prepayment floors ranging from 1-3% of the loan balance, so they can’t realize the potential to exit at par or at a discount.

- The length of term to maturity: The longer the remaining term on the loan, from the defeasance date to loan maturity, the greater the fluctuation in exit costs.

The fundamentals of a loan defeasance or yield maintenance prepayment point to the DCF model of discounting future loan payments, of principal and interest, to present value. At its core, sensitivity to rate movements is greatly dependent on the length of time remaining from the defeasance date to the final maturity date. The ‘dollar value’ of 1bps of rate movement (DV01) +/- will be much different for a loan maturing in 1 year versus another maturing in 5 years; with the 1y scenario being least and the 5yr being most sensitive.

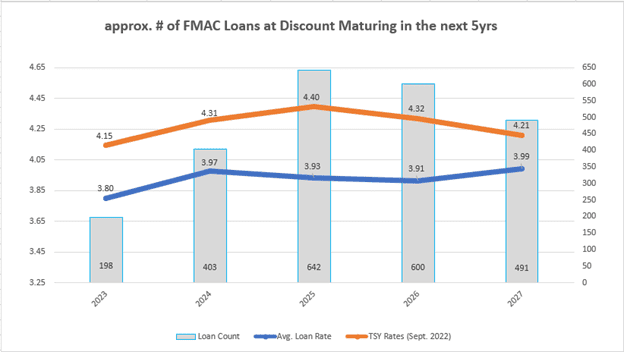

Below is a high-level overview of AGCY (Freddie Mac) loans, maturing in the next 5 years, that can be potentially defeased at ‘par’ or ‘discount’ to outstanding principal. This proves to be one of the few bright spots for CRE investors when so many other market factors are negatively impacting transaction economics.