Regional bank bankruptcies can have a significant impact on the commercial real estate (CRE) market. When a regional bank fails, it can affect borrowers, investors, and lenders alike. A bankruptcy can trigger a cascade of events that may cause borrowers to lose access to credit, and other potential issues. This, in turn, can make it harder for borrowers to refinance their loans or sell their properties.

Read ahead to learn how regional bank bankruptcies can affect commercial real estate loans and four steps you can take to minimize your risk.

What Happens When Regional Banks Fail?

Banks generally fail when they no longer have enough funds to cover total customer deposits and debts. Recently, three regional banks failed: Silicon Valley Bank (SVB) and Signature Bank both in March 2023 and First Republic Bank in May 2023.

As a result, bank failures are likely to increase scrutiny of loan applications across the industry while banks at the same time seek to reduce their exposure. This double whammy will make loans much harder to get. Regional banks like SVB disproportionately lend to CRE borrowers, so they will face the most scrutiny in the short term. And even loans that close will be more expensive as interest rates continue to rise, although more slowly now than in 2022.

A huge wave of refinancings is coming as well, a lot of it in uncertain markets like the office sector. Many borrowers will be hard-pressed to refinance maturing debt in today’s higher interest rate environment, and defaults will disproportionately affect banks since the market for mortgage-backed securities has fallen 75% since its peak in 2007.

Why Do CRE Borrowers Rely on Regional Banks for Loans?

Commercial real estate borrowers often rely on regional banks for several reasons. Regional banks tend to have a deeper understanding of the local real estate market than national banks. They possess extensive knowledge about the area’s economic conditions, property values, and market trends, enabling them to make informed lending decisions. This localized expertise allows borrowers to benefit from tailored financial solutions and guidance specific to their geographic region.

Secondly, regional banks often exhibit a greater flexibility in their lending practices compared to larger national or international institutions. They are typically more open to negotiating terms and accommodating the unique needs of individual borrowers, including customized loan structures or repayment plans. This flexibility fosters a more collaborative and personalized approach, which can be highly advantageous for commercial real estate borrowers seeking financing solutions that align with their specific business goals.

Lastly, regional banks tend to prioritize building and maintaining strong relationships with their customers. By fostering long-term connections and offering a high level of personalized service, these banks are able to provide ongoing support to borrowers throughout the entire loan process and beyond. This commitment to customer satisfaction and relationship building creates a sense of trust and reliability that further solidifies the reliance of commercial real estate borrowers on regional banks.

How Can Regional Bank Bankruptcies Affect CRE Loans?

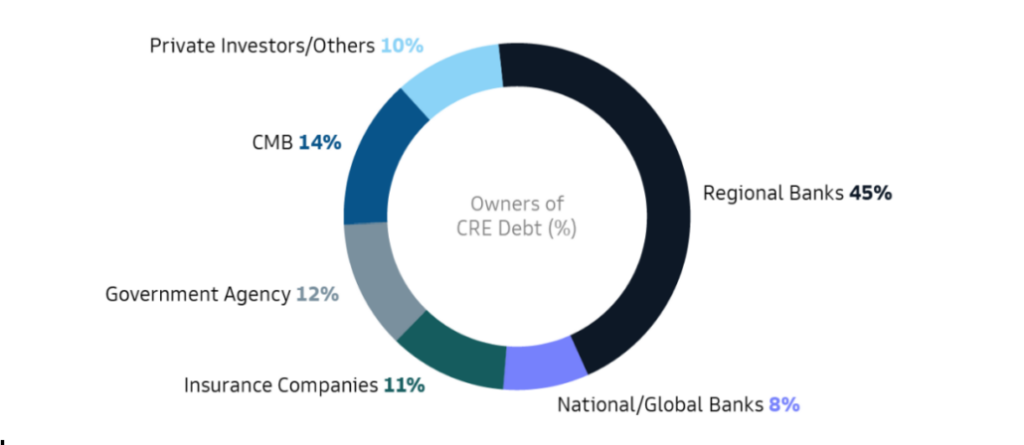

According to the Mortgage Bankers Association data, the total size of CRE debt is around $4.5 trillion. We also are facing a maturity wall of close to $1 trillion in CRE loans maturing by the end of 2024, according to Bloomberg data. Bank lending accounts for 53% of the outstanding CRE debt, with the majority held by regional banks. In fact, Goldman Sachs reports that 45% of CRE debt is funded by regional banks.

Source: Autonomous, Mortgage Bankers Association, FED Flow of Funds, SNL (Bank Loans), Morgan Stanley, Statista, McKinsey, NAREIT, Goldman Sachs Asset Management. As of March 31, 2023.

Below are some of the impacts that regional bank bankruptcies can have on CRE loans:

Affect #1: Reduced Access to Credit

When a regional bank fails, it can create a credit crunch as borrowers lose access to credit. This can make it harder for commercial real estate borrowers to obtain financing for new projects or refinance existing loans.

-

Loss of Financing Options:

When a regional bank fails, it can reduce the number of financing options available in the market. This can make it more difficult for commercial real estate borrowers to find lenders willing to finance their projects.

-

Tightening of Credit Standards:

Regional bank failures can cause lenders to tighten their credit standards as they become more risk-averse. This can lead to a reduction in the amount of credit available for commercial real estate borrowers.

-

Market Uncertainty:

Bank failures can create market uncertainty, which can cause lenders to become more cautious about lending. This can make it harder for commercial real estate borrowers to obtain financing, even if they have a strong credit history and a good track record.

Affect #2: Difficulties Refinancing Or Selling Properties

Lack of liquidity: Bank failures can create a lack of liquidity in the market, making it harder for borrowers to find buyers or refinance their properties. This can be especially challenging for borrowers who need to sell or refinance their properties quickly.

3 Steps to Minimize Risks from a Regional Bank Bankruptcy

As a borrower or investor in commercial real estate, there are steps you can take to minimize your risk in the event of a regional bank bankruptcy.

Diversify Your Lenders

One way to minimize your risk is to work with multiple lenders. By spreading out your loans across several lenders, you reduce your exposure to any one lender. This action can help you avoid the negative consequences of a regional bank bankruptcy.

Review Your Loan Agreements

It’s essential to carefully review your loan agreements to understand your rights in the event of a bankruptcy of your bank. Ensuring your lender fully funds their obligations in a timely manner is key to ensuring your projects are completed and delivered on time.

Monitor Your Reserve Accounts

Keeping a close eye on loan reserve balances and reimbursement requirements can help you avoid having reserves held by a failed bank. By staying on top of accounting and reimbursement requirements, you can take proactive action to receive those funds quickly to utilize as intended.

About Thirty Capital Financial:

Thirty Capital Financial is a leading service provider to the commercial real estate industry. Our team of advisors have spent decades providing solutions for defeasance, interest rate hedging, and debt management. With our personalized approach, we provide you with the tools, solutions, and strategies to confidently manage debt while supporting the growth of your company. Contact us today to speak with an expert!