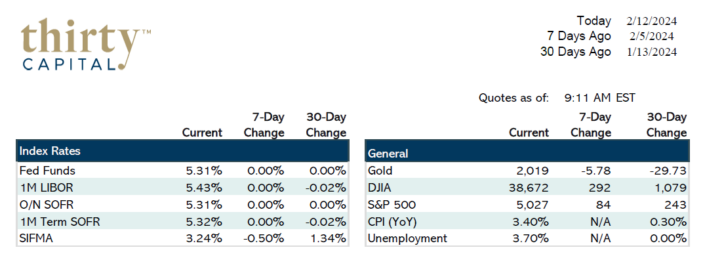

Last week the two- and ten-year Treasury yields rose 12 and 15 BPS, respectively. ISM Services numbers came in stronger than anticipated on Monday, sending rates up about 11 BPS on the front end. Led by a troubling report from NY Community Bank, there were some concerns on Tuesday about a potential real estate-centered banking crisis. This sent rates back down about 7 BPS on the day. It’s still unclear if we’re looking at a widespread issue in the banking sector.

Rates trended back up later in the week but not due to any specific economic data points. Several policy makers and Fed governors said there’s no longer a rush to lower rates. This week, we have some big numbers coming out: CPI data tomorrow, Retail Sales on Thursday, and PPI on Friday.

Per Bloomberg’s WIRP (World Interest Rate Probability) ticker, there are still 4.5 cuts priced in for the remainder of 2024. Thirty Capital’s view remains that this is an aggressive number of cuts based on various economic data points and given what we’re hearing from the Fed. The chance of a cut in March is now just 18%, per Bloomberg’s WIRP model.

It’s still a great market to roll forward caps (and other hedges) that are within six months of maturity. Although, the discount compared to a spot starting hedge isn’t quite as severe anymore. Most of the curve’s inversion is within the first 16-18 months. There are probably diminishing returns if you go much further forward than that.

There were three Treasury auctions last week that went incredibly well. They accounted for the three largest debt sales in US history. It’s tough to say exactly what this could mean for the economy, but it’s certainly encouraging to see there’s a strong appetite for US Treasury debt.

About Thirty Capital Financial:

Thirty Capital Financial is a leading service provider to the commercial real estate industry. Our team of advisors have spent decades providing solutions for defeasance, interest rate hedging, and debt management. With our personalized approach, we provide you with the tools, solutions, and strategies to confidently manage debt while supporting the growth of your company. Contact us today to speak with an expert defeasance consultant!