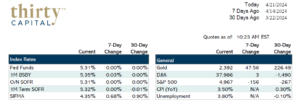

Last week, we saw a steepening yield curve with 2-year Swap rates up 7 BPS and 10-year swaps up 10 BPS. Retail sales data came in hotter than expected, and Fed rhetoric suggested there’s no current timeline for cutting rates at this point. This is the latest of the hot economic prints that have sent the Fed’s plans to the wayside. Rate cuts are being pushed further and further off the table. Perhaps we will still see one cut before Q4, but this is purely speculative, and the data is not giving the answers we want at the moment. Rates are up more thus far, particularly on the long end of the curve. No matter how far out you look on the forward curve, rates basically bottom out around 4%. The market expectation is now certainly “higher for longer”, and government spending is not decreasing inflation (yet).

This week, we have three TSY auctions that will be closely watched. 2’s, 5’s, & 7’s will be auctioned off over the next few days, and all three will be of record size. It’ll be telling to see how the market absorbs these auctions. We have PCE figures coming out on Friday, which will also be closely watched since it’s Powell’s preferred measure of inflation. Hotter than expected PCE data would likely move rates even higher, but since it’s a Friday release, PCE could take some volatility out of the market. A lot of folks will be hesitant to trade ahead of it.

Many institutional players remain on the sidelines, and they seem to be using cash if they are in the market. Fannie & Freddie are being aggressive from a spread standpoint, but the all-in coupons are still making it tough to get deals done. We may be looking at more defaults, with people moving on from the “extend & pretend” era. Many of the deals being pushed out 3-6 months will have to start unwinding toward the end of this year. On another note, institutional-level money managers/banks have come back with a strong appetite to invest in Agency CMBS pools.

On a macro level, the Senate passed a $95B aid package to Ukraine, Israel, and Pan-Asia. The House didn’t pick it up, but Johnson moved it forward as three separate bills, which all passed the House.

About Thirty Capital Financial:

Thirty Capital Financial is a leading service provider to the commercial real estate industry. Our team of advisors have spent decades providing solutions for defeasance, interest rate hedging, and debt management. With our personalized approach, we provide you with the tools, solutions, and strategies to confidently manage debt while supporting the growth of your company. Contact us today to speak with an expert defeasance consultant!